BridgingFX offers you a complete package that helps you to start your own FX and OTC broking company during United Kingdom (via Financial Conduct Authority, London). We offer a complete package that will help you in every step of the way that maintains trust and utmost business confidence in United Kingdom Forex Company Formation.

Our full package services come with all the mandatory requirements that are crucial for a successful registration and renewal with the FCA and compliance procedure with the regulatory body.

Notarized passport copy (Should be notarized in English – 2 copies).

Last 3 months utility bill (Should be notarized in English – 2 copies with original)

Director/Shareholder’s Bank reference letter

Lawyer’s reference letter

The copy of educational degree certificate (Should be in English)

Director/Shareholder’s CV

Criminal record check certificate

1/3rd of office staff should hold the citizenship of the UK (not mandatory)

FCA, United Kingdom Application Form.

Statutory Declarations.

Bank application forms.

AML Procedures.

Business Plan.

3-year financial forecast.

Balance sheet with forecast description.

AML/CFT FAQ’s Declaration.

Note: The ad-hoc additional documents maybe requested from any authority or institution during the process.

Deposit

Liquid Cash

Share Capital

Required Amount(in $)

$7,50,000

NA

London is one of the best cities in the world in terms of foreign investments and hedge funds. The reason behind this is the strongest GDP growth rate. It is the home of the richest people in the world and mostly referred as strongest capital hub for new investment.

FCA, London has some of the major Forex brokers who are duly authorised with FCA Broker License. It is regarded as one of the toughest and strongest regulatory procedure to obtain Forex license. It is usually termed as best regulatory body in the world at par with NFA.

Tax Rate System:

1. Individual Tax System starts from 20%

2. Corporate Tax is just 20%

The majority of the Forex brokers in the world crave for United Kingdom Forex Broker License due to the high amount of business opportunities from EU region. United Kingdom is one of the biggest FX trading markets in the world with a daily turnover of $2.6 trillion/day (BoE).

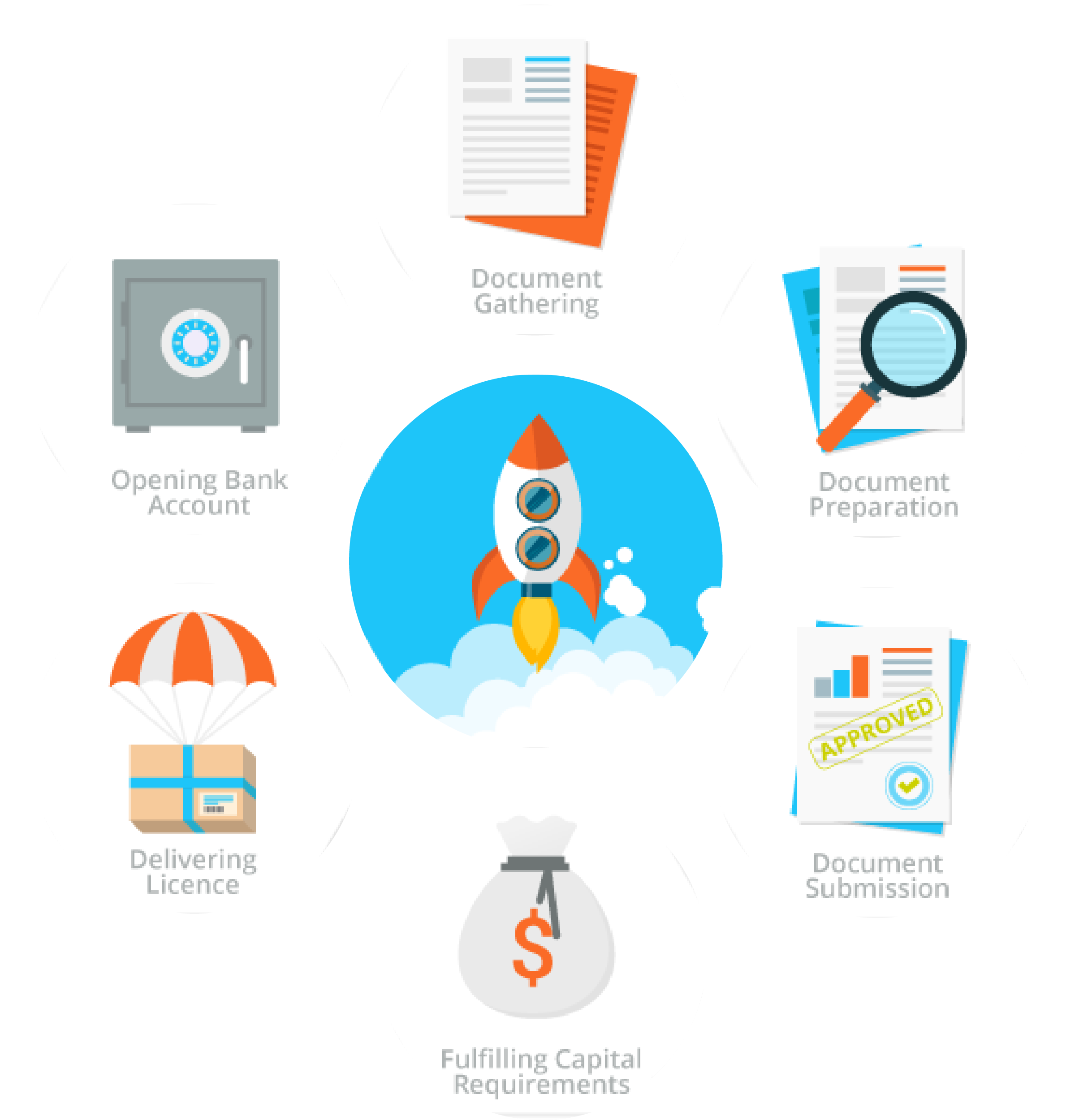

We prepare all the required documents as prescribed by the regulatory body, including due diligence.

Prepare AML procedures with a strong code of conduct implemented by FCA and custom tailored business plan.

Submit the application to the FCA, London

Forming a new company in UK with European entity director.

Submission of all the corporate documents to the FCA, London. We open company’s bank account with physical office address in order to satisfy paid up capital requirements which include due diligence documents.

We make provision of minor documents and other Ad-hoc support required during the process.

Satisfy the minimum capital requirement by FCA, London.

Opening of a corporate account in EU bank for operational needs.

Submission of the letter from the bank to the FSC that capital requirements are fulfilled.

Receipt of license from the regulatory body and delivery of documents to the Client.

Hiring external auditor for required compliance and KYC fund source.

You Will Receive Quote Within 24 Hrs.

Where We Are

Where We AreKemp House 160 City Road London – United Kingdom EC1V 2NX

+44-2036958896

contact@bridgingfx.net